Here's How Climate Solutions Defeat Themselves

Let’s all get out there and fight for a new carbon tax, one advocate insisted earlier this month. Because that worked so well the first time.

Could an unnatural obsession with leaf blowers help undo a decade of on-again, off-again progress on Canadian climate policy and climate solutions?

It just might, if a noisy, high-emitting, and pretty much universally unnecessary lawn care device became the visual cue for doubling down on a stunning political liability.

At an event in Toronto earlier this month, leaf blowers were presented, not incorrectly, as a defining example of a tax and pricing system that drives up climate pollution by encouraging wasteful, high-emitting consumer habits. So far, so good.

But the solution on offer sent chills up my spine, and not in a good way. We were told that by introducing the kind of tiered value-added tax (VAT) that already exists in the vast majority of European countries, some future Canadian government could use the tax system to reward climate-friendly purchases and price the worst products out of the market.

I learned days later that no one was seriously proposing to introduce the idea into a federal pre-election that is already fraught with deep peril for national climate policy. But in the moment, the idea was terrifying—a proposition that sounded great in theory but couldn’t possibly work in practice, put forward by a supremely confident advocate who knew it must be true…because economists said so.

Right Place, Wrong Idea

When I arrived at this year’s Canada’s Clean50 Summit, I didn’t expect that we would spend part of the day (90 minutes out of an excellent, 12-hour day) relitigating the national carbon tax. (And to emphasize right up front—The Weekender is always an opinion and analysis piece. But take it as given that, especially on a topic as entrenched and contentious as the carbon tax, there are bound to be multiple views on how that 90-minute session went.)

The Clean50 is a remarkable network of sustainability and climate leaders, held together through a remarkable, 14-year effort by its founder, Gavin Pitchford. I was grateful to be brought into that network two years ago, and so far beyond thrilled by so many of the projects, front-line practitioners, federal and provincial policy leaders, and relentless, day-in, day-out over-achievers who were recognized this year. (As a matter of fact, yes, it was a bit of a stretch to shoehorn a dozen links into that sentence.) You can find the full list of this year’s Clean50 honourees here, a brilliant list of winning projects here.

An important feature of the Clean50 network is that it’s meant as a continuing commitment for those who want it to be, not a one-off award. Honourees are invited to stay in touch when the moment calls for advocacy around specific climate and sustainability policies. (Full disclosure: Energy Mix Productions is and will continue to be an active member of that network.) Earlier this year, the Clean50 produced one of the two sign-ons that helped keep the door open for a partial win on sustainable finance disclosures—a longstanding issue that is crucial to Canada’s climate performance as well as its standing with international trading partners.

That was the context when the Clean50 scheduled a “what’s next” conversation on the carbon tax at this year’s summit, with leaf blowers as Exhibit A for the truly awful economic signals we all receive as everyday consumers. Past Clean50 statements have almost always supported “pricing externalities,” Pitchford told me afterwards, economics-speak for setting a higher price as a deterrent for products that harm people and the environment. So the question du jour was whether everyone would (or in this political context, should) sign on to a statement that recognized a variable-rate VAT as a useful climate policy tool.

“The carbon tax isn’t going to exist in a year,” Pitchford said, and “it’s not changing day-to-day behaviours in the way it should.” So “we were hoping the Summit would come up with ideas for how this might work and what it would look like,” with no expectation that anyone would announce or advocate for it in the immediate future.

We’ve Been Here Before

Unfortunately, that’s not the way it was presented, at least not in the breakout group I attended. Instead, it sounded like a replay of the 10 to 15 years we’ve just been through.

In the first go-round, carbon pricing was an idea dreamed up by neoclassical economists whose theoretical models largely failed to factor in the realities of a warming world, or the real-world needs and behaviours of the people who inhabit it. They did succeed in what appeared to be their primary goal—positioning the climate emergency as a problem to be addressed by traditional market forces, not through the direct regulation, public mobilization, gradual fossil fuel phasedown, and local economic transitions that would actually treat climate change like the global emergency that it is. And get the job done of bringing it under control.

After taking up all the oxygen in the room through years of political debate, supplying endless fodder for federal-provincial posturing, and being fought all the way to the Supreme Court, carbon pricing finally survived. For a little while. Now it’s been reduced to a ridiculous three-syllable rhyme, the leading edge of a sweeping political shift that appears poised to burn national climate policy to the ground.

And all the while, Canada somehow managed to manoeuvre itself into a position where the most visible cornerstone of the plan to address the toughest crisis facing humanity was…a new tax, decades into an era of massive public conditioning to unconditionally despise all taxes.

You’d have to be a neoclassical economist to think that one up, to think it might work. Oh, wait…

A Good Lesson to Learn

None of which is to fault Canada’s Clean50 for bringing this topic to the surface, even if we badly need it to sink without a trace. The point of asking a provocative question is to generate debate and get a forthright answer, and that answer isn’t always what we want or expect.

But the real contribution here, even if it wasn’t the original plan, is a lesson learned that could apply right across the climate community if we’re prepared to hear it.

The Clean50 is just one of the many voices that have advocated long and loud for carbon pricing. And it makes sense to treat pricing as one tool in a toolbox of climate policies—and to set it up so that it actually delivers results—as long as it isn’t pushed forward as the leading edge in a public fight for hearts and minds, for action and momentum.

The fatal flaw in the original concept of consumer carbon pricing was that it piled expectation on top of assumption about how people would, could, or should respond to price signals, without stopping to ask whether that theoretical “economic actor” existed in real life. The evil genius in the hyper-politicized opposition to carbon pricing—and to the full suite of climate policies by extension—is the recognition that people are hurting. That affordability is top of mind. That when you’re struggling with your rent or mortgage, juggling two or three jobs to get by, or forced to choose between food and fuel, you can’t afford to think twice about supporting someone who promises to cut your taxes.

Particularly when the proponents of that tax have done such a poor job of explaining that most of us receive more back in rebates than we pay out in higher costs.

By now, we’re almost certainly past the point where those details matter. Or where the rational arguments for a VAT, modelled on European programs that date back decades, to a less politically polarized time, would do anything more than further erode support for the climate policies we need.

It isn’t where we would choose to be. But it’s what we’ve got. And with the federal election looming next year, the one thing the climate community doesn’t need is to defeat our own best efforts before we get started.

Mitchell Beer traces his background in renewable energy and energy efficiency back to 1977, in climate change to 1997. Now he and the rest of the Energy Mix team scan 1,200 news headlines a week to pull together The Energy Mix, The Energy Mix Weekender, and our weekly feature digests, Cities & Communities and Heat & Power.

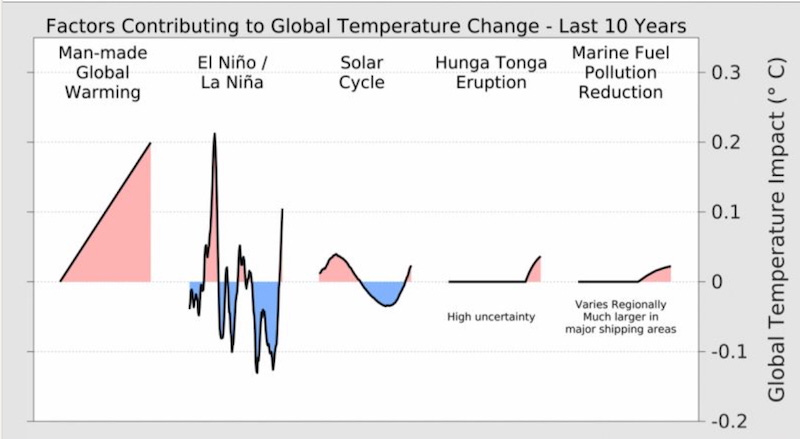

Chart of the Week

Hydrogen Projects Delayed, Cancelled as ‘Hype’ Meets Reality

EVs, Energy Efficiency Save Canadians Up to $921/Month, But Access is Slipping Away

Batteries Save the Day After Norway-UK Power Link Fails

New Restrictions Could Close Off 40% of Alberta to Renewable Energy Development

‘Humanitarian Emergency’ in Norman Wells, NWT as Drought Drives Up Cost of Living

Ocean Catches Fire after Gas Leak from Underwater Pipeline

IEA Proclaims ‘Age of Electricity’ as Batteries, Solar Surge—But Emissions Still Way Off Course

New Federal Law Boosts Offshore Wind Off Canada’s East Coast

Oil Giants Dip into Clean Energy, Metals as Fossil Fuel Era Fades

Hydro-Québec announces new wind farm generating up to 1,000 MW in eastern Quebec (Canadian Broadcasting Corporation)

U.S. Supreme Court clears way for Biden’s plan to cut power plant emissions (Washington Post)

'Climate change is to blame': England suffers one of its worst harvests on record (Business Green)

China intensifies emergency food supply amid increasing extreme weather events (Xinhua)

Hellish heat and primal fear: Croatian firefighters on frontline of climate crisis (The Guardian)

TotalEnergies Contracts Fourth LNG Refueling Ship (Rigzone)

Iranian authorities working to control oil spill off Kharg Island, report says (Reuters)

Virginia Utility unveils plans to add 21 GW of clean energy, 5.9 GW of gas generation by 2039 (Utility Dive)

These busted solar panels are an early example of a looming problem — and an opportunity (Canadian Broadcasting Corporation)

Tax on Europe’s frequent flyers could raise €64bn a year – study (The Guardian)

How Big Is The Energy Efficiency Resource? (RMI)

Keir Starmer vows to rip up bureaucracy to unleash ‘shock and awe’ of investment (Financial Times)