China’s Peak Oil Demand Bombshell Eviscerates Danielle Smith’s Energy Strategy

Time to reconsider Alberta’s 'dangerously inept' Emissions Reduction and Energy Development Plan, writes Energi Media's Markham Hislop.

We’re passing the mic this week to one of Canada’s leading energy journalists and analysts, Markham Hislop. This post originally appeared on Energi Media in late December, 2023.

China dealt a serious political blow to Alberta Premier Danielle Smith in late December when the country’s largest refiner, state-owned Sinopec, released its latest long-term energy forecast. Oil demand is now expected to peak in just a few years, not in 2045 as the Organization of the Petroleum Exporting States (OPEC) has predicted. Sinopec’s announcement calls into question Alberta’s energy strategy, which is based upon growing global oil and gas consumption to 2050.

Smith has been a vocal supporter of the “slow energy transition” narrative promoted by Saudi Arabia and other Middle Eastern oil-producing countries.

At the World Petroleum Congress, hosted in September by Calgary, the Premier lambasted the International Energy Agency (IEA) for forecasting global peak oil demand by 2030. At a September 18 news conference, she accused the IEA of abandoning its 50-year-old role of “doing predictions” and instead indulging in “political advocacy”. Smith praised Saudi leadership in her remarks.

“I feel like we’re going to be in a bit of a technological and innovation race with Saudi Arabia, and I think we heard that from the [Saudi] energy minister this morning,” she told reporters. “He intends to lead the world in this and he is challenging the rest of us to keep up. Alberta wants to keep up.”

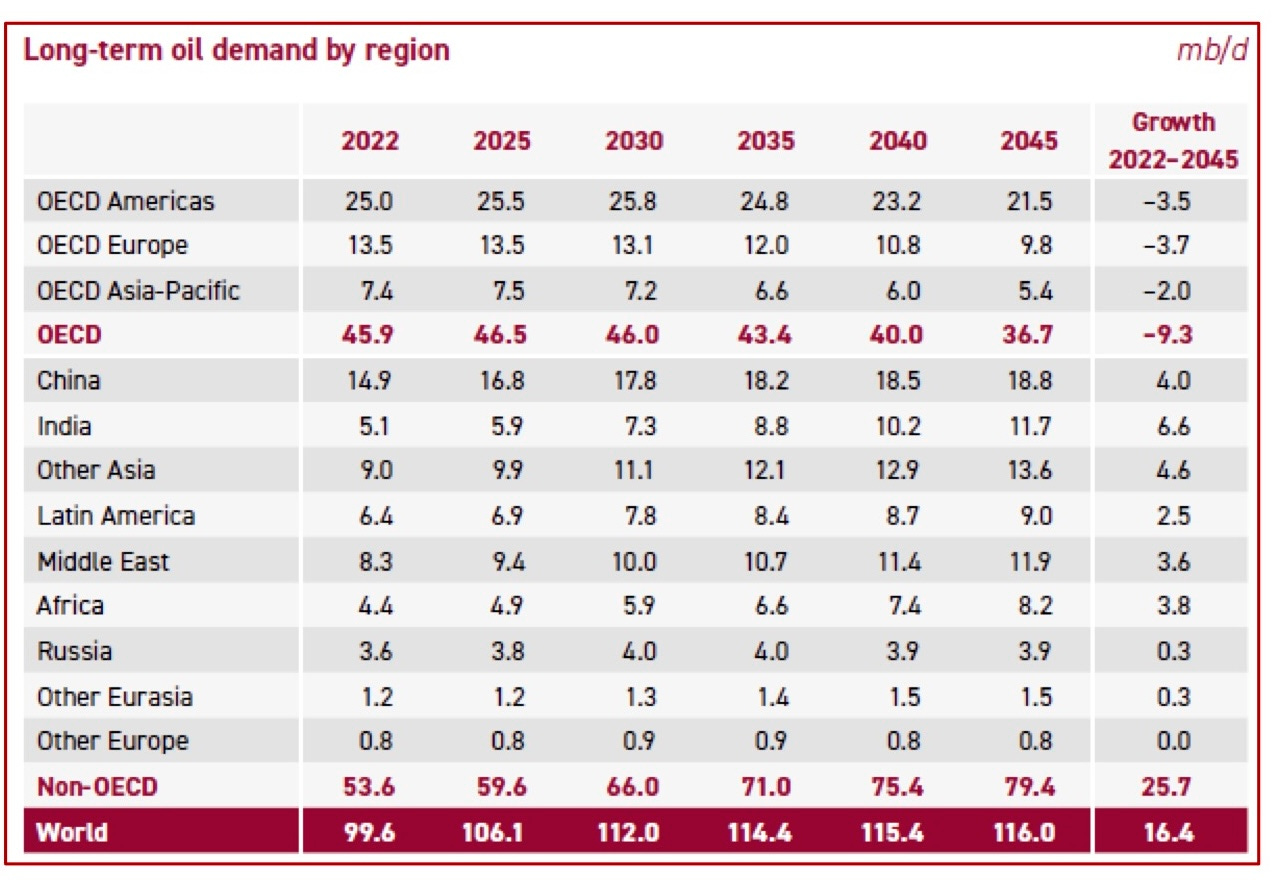

Saudi Arabia is the leader of OPEC, the oil cartel that has been cutting production by millions of barrels per day to prop up prices during a softening of the international economy. The organization released its oil forecast a few weeks after the World Petroleum Congress. The report predicts continued growth of oil consumption to a peak of 116 million barrels per day by mid-century, up from 100 million barrels per day in 2022.

China Sees a Different Future

China plays a prominent role in OPEC’s World Oil Outlook 2045. The world’s second largest oil consumer is forecast to use 18.8 million barrels per day by 2045, an increase of four million barrels per day from 2022 levels.

Sinopec’s report estimates that demand will peak at 16 million barrels per day between 2026 and 2030. The China National Petroleum Corporation thinks Chinese gasoline demand will peak in 2025, followed soon after by diesel, and then shrink 2.3 per cent annually until 2030.

The cause of China’s peak oil demand is the more rapid than expected electrification of transportation. In the third quarter of 2023, 38% of passenger cars sold in China were electric. The country has already switched most of its bus fleet to electric (approximately 600,000 in service) and almost half of two- and three-wheelers, an important mode of transport in Asia, are electric.

Sinopec credits China’s “dual carbon” energy strategy for peaking oil demand. In an Energi Talks podcast interview, Eurasia Group analyst Herbert Crowther explains President Xi Jinping’s plan to massively boost renewable energy and electric technologies (e.g. EVs, heat pumps) while slowing use of fossil fuels.

China’s energy trends are not a mystery. But too many players in the oil and gas industry, including leaders of the Alberta sector, prefer to dismiss China’s electrification efforts by pointing to massive coal use in the power sector.

‘Wildly Over-Optimistic’

One wonders how OPEC’s modellers got it so wrong. And, perhaps more importantly, what other assumptions will prove to be wildly over-optimistic.

The much maligned (at least in Alberta) IEA got it pretty much dead on with its China oil demand forecast. “Oil consumption peaks at 16.6 [million barrels per day] before 2030, ending decades of growth, and then declines steadily to 12 [million barrels per day] in 2050,” the IEA said of its business as usual scenario in the World Energy Outlook 2023. The announced policies scenario, the more likely in my opinion, pegs 2050 demand at seven million barrels per day.

When I pointed out to Smith that many other forecasters also call for peak oil demand around 2030, she laughed and noted that the Saudi energy minister “actually challenged the group to find a single time that the IEA has had a single projection that has been correct. So, I think it takes a leap of faith to think that if they’ve never been correct, that they will be correct by 2050.”

Energi Media has pointed out many times that the Premier’s grasp of global energy trends is, to be generous, slight. My follow-up question at the September 18 news conference asked if she was listening to other voices on the future of energy. Instead of directly answering the question, she again lauded Saudi Energy Minister Abdulaziz bin Salman Al Saud’s view that petroleum consumption will grow, not diminish.

This premier is not for turning.

An Existential Threat to Alberta

The biggest trend missed or minimized by OPEC’s modellers, Smith, and frankly most of the Alberta oil and gas leadership, is that the United States and Europe are now frantically trying to catch up with China. North America, the European Union, and the United Kingdom have devoted trillions of dollars over the next decade to building out clean energy technology manufacturing and subsidizing the adoption of key technologies, like electric vehicles. China intends to match their efforts.

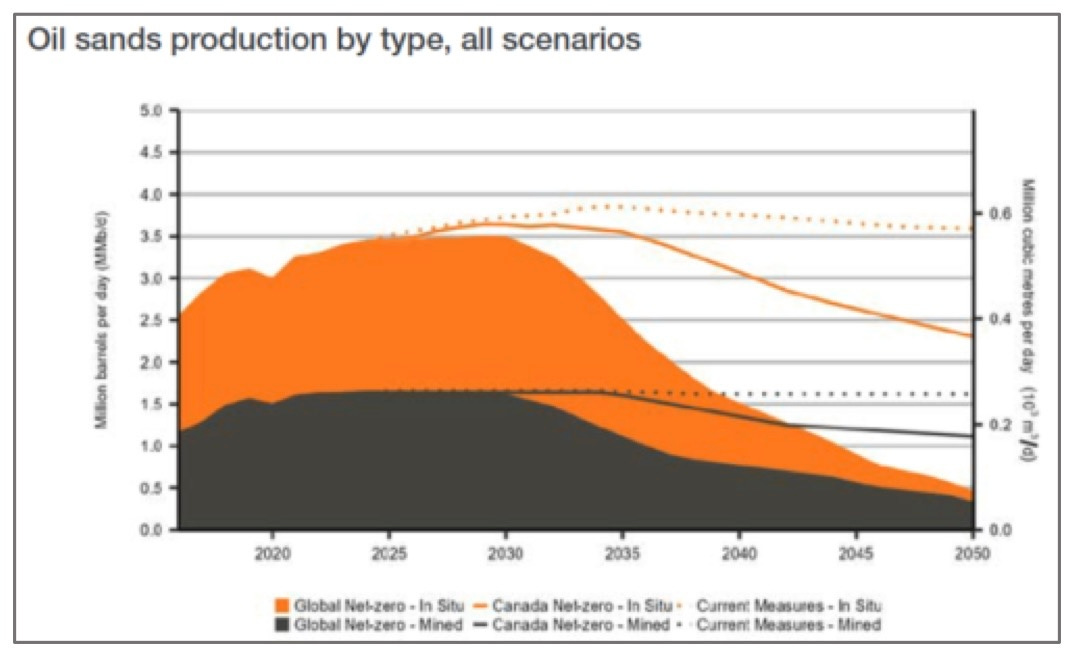

That competition has sparked a global clean energy arms race. How it plays out remains to be seen, but one thing is certain: the trends don’t favour Alberta’s hydrocarbon extraction sector. Modelling by the Canadian Energy Regulator, for example, shows oil sands production likely declining sometime in the 2030.

Despite clanging alarm bells like Sinopec’s announcement, Smith and her government continue to think of the global energy transition as an oil and gas marketing opportunity, not an existential threat to the province’s biggest industry. Instead, now is a good time for Smith to reconsider her dangerously inept Emissions Reduction and Energy Development Plan.

Unfortunately, that is unlikely to happen. Smith is a political animal and her “slow transition/oil and gas export opportunity” narrative is too popular among her supporters, especially those in the oil and gas industry, which is chomping at the bit to expand.

Don’t expect her to recognize the significance of Sinopec’s peak demand bombshell. The announcement will be largely ignored in Alberta. That doesn’t make it less of a bombshell. The slow transition narrative is rapidly unravelling. Sooner or later, the province’s political and business leaders will have to acknowledge their mistake. For the sake of the rest of Alberta, let’s hope the necessary self-awareness comes sooner.

Energy journalist Markham Hislop has been publishing at Energi Media since 2015. His areas of interest include clean energy and cleantech, electric vehicles, climate and energy policies, green finance, hydrogen, oil and gas adaption…and much more.

Mitchell Beer traces his background in renewable energy and energy efficiency back to 1977, in climate change to 1997. Now he and the rest of the Energy Mix team scan 1,200 news headlines a week to pull together The Energy Mix, The Energy Mix Weekender, and our weekly feature digests, Cities & Communities and Heat & Power.

Chart of the Week

UPDATE: Federal Budget to Include Revamped Greener Homes Grant

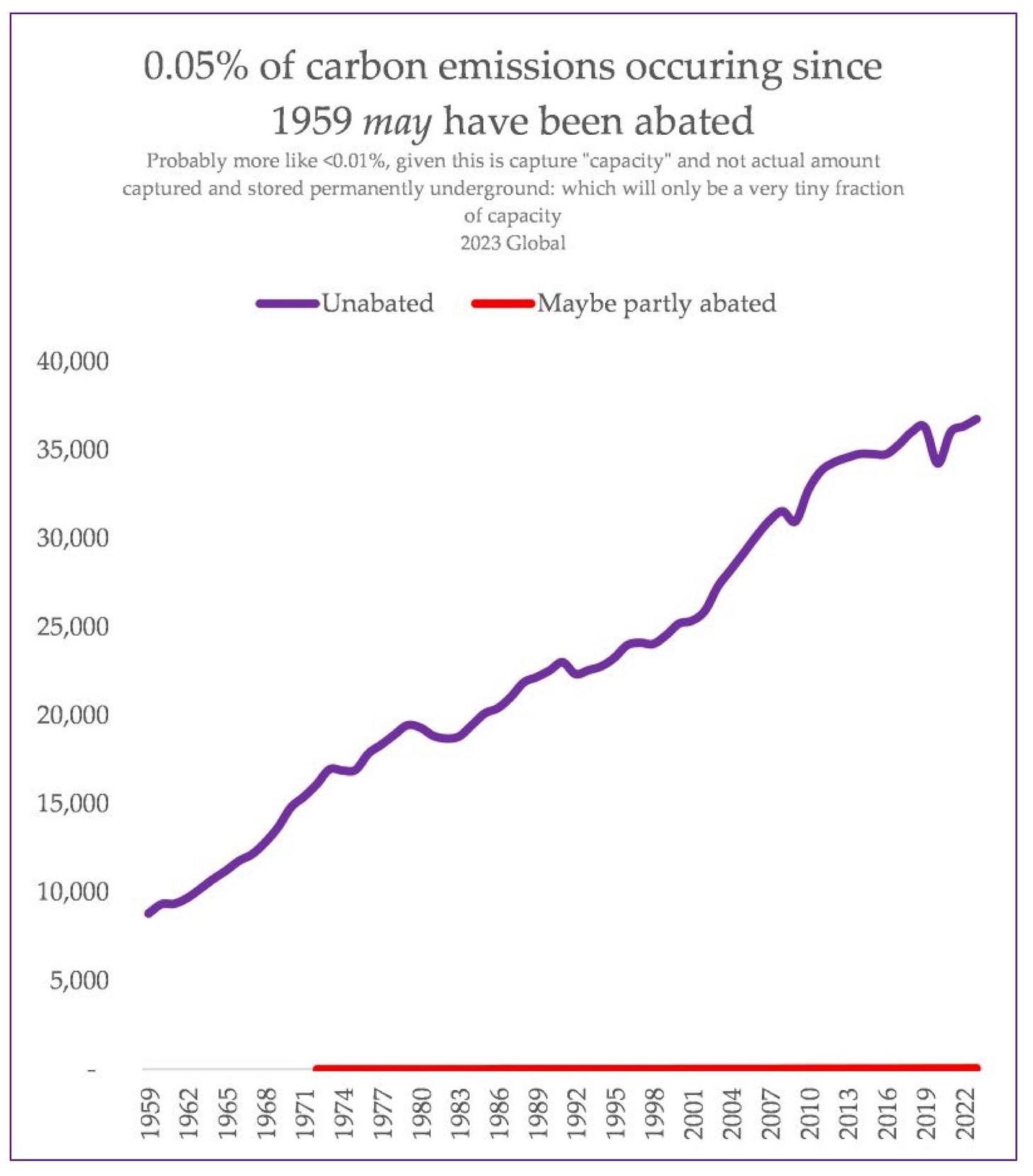

Ottawa Offers Grids More Flexibility to Burn Natural Gas, Use CCS

Alberta CCS Project Could Be ‘Scuppered’ without Permanent Subsidies, Industry Analysts Warn

Experts Declare Scope 3 ‘Conundrum’ a Fading Myth Amid New Disclosure Rules

Manitoba Fires Hydro CEO, Looks to Public Power to Meet Looming Shortfall

Ottawa Faces ‘Profound’ Political Impacts after Carbon Tax Messaging Falls Flat

‘Batteries on Wheels’ Can Cut Peak Power Demand, Put Money in Customers’ Pockets

Puerto Rico’s 100% Renewables Expansion Can Spare Farmland, Study Finds

UK Steel Closures Show Risky Path to Decarbonizing Heavy Industry

Canada secures surrender of all offshore Pacific coast oil and gas permits (Reuters)

New York State Restricts Investments in ExxonMobil, But Falls Short of Divestment (Inside Climate News)

World’s largest oil companies have made $281B profit since invasion of Ukraine (The Guardian)

Emissions cap needed to spur reductions from highly profitable energy industry (Calgary Herald)

Oil majors reshape portfolios with $30-per-barrel price in mind (Reuters)

How to do climate policy in the age of the green backlash (Financial Times)

Why global support for climate action is ‘systematically underestimated’ (Carbon Brief)

The Planet Needs Solar Power. Can We Build It Without Harming Nature? (New York Times)

The overlooked health impacts of extreme rainfall exposure in 30 East Asian cities (Nature Sustainability)

UAE, Azerbaijan, Brazil join forces to limit global warming to 1.5°C (Al Jazeera)

Biden vs. Trump: Do young climate voters care? (Politico)

Switzerland proposes first UN expert group on solar geoengineering (Climate Home News)