Geological Carbon Storage: Massive Scale, Hidden Risks, Eternal Monitoring

Carbon storage is a dodgy, leaky practice in simpler settings like depleted oil wells. It's a disaster waiting to happen if it scales up, costing taxpayer billions per year for thousands of years.

We’re passing the mic again to climate tech specialist and author Michael Barnard. This post originally appeared on CleanTechnica. Republished with the author’s permission.

The Weekender was in production when news broke that the Trump administration had bombed three nuclear sites in Iran, bringing an already volatile and dangerous moment to a new level of chaos and uncertainty. (Because…Trump. Of course it did.)

We’ve been following developments closely, but at this point there are just too many unknowns to assess the top-line news, much less the implications for the climate and energy transition, beginning with the impact on world oil prices. As U.S. commentator Robert Reich writes on Substack this morning, “be strong. Be safe. Hug your loved ones.”

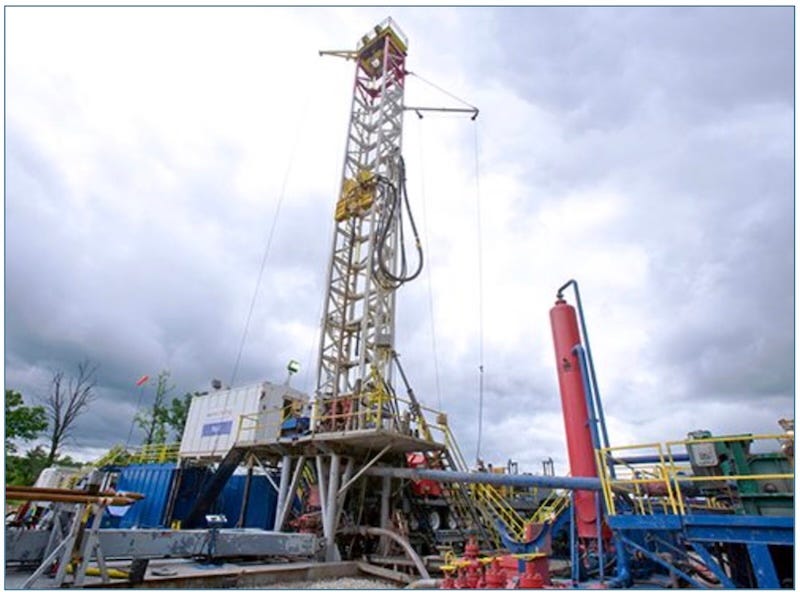

The notion of geological sequestration of carbon dioxide as a climate mitigation strategy has gained prominence, largely on the back of a scenarios that aren’t aggressively electrifying, and on the strength of extensive fossil fuel industry lobbying. However, experiences from the oil industry’s existing use of carbon dioxide in enhanced oil recovery (EOR) cast significant doubt on the feasibility of achieving permanent geological storage at the ambitious scale required.

EOR operations currently inject tens of millions of tonnes of CO2 each year, using the lion’s share of the carbon captured to force more oil out of the ground. But then, studies reveal troubling leakage rates, with mechanical integrity tests indicating that roughly 11% of EOR wells have had leaks sufficient to compromise their intended containment.

This failure rate is far from negligible, particularly when viewed in the context of climate goals, which demand virtually zero leakage over centuries or even millennia.

This finding is concerning precisely because current EOR wells typically experience far less demanding conditions than future sequestration wells. In EOR operations, pressures and chemical aggressiveness are often comparatively modest, with lower concentrations of dissolved carbon dioxide and shorter anticipated lifespans.

A Warning Signal for Geological Storage

In contrast, dedicated sequestration wells must reliably contain supercritical carbon dioxide, often saturated with brine under high pressures, conditions that drive corrosive reactions at a rate exceeding those commonly observed in EOR scenarios. Given these harsher environments, the already concerning leakage rate from EOR wells serves as a warning signal about what could occur when sequestration is scaled up dramatically.

Geological sequestration as proposed involves not tens of millions, but billions of tonnes of carbon dioxide each year. Recent projections, such as those from the International Energy Agency, suggest that global sequestration rates would need to scale to around 7.6 gigatonnes per year by mid-century to align with net-zero emission targets. This represents a scale-up exceeding two orders of magnitude beyond current combined EOR and dedicated sequestration capacity worldwide.

Achieving such a vast expansion requires an unprecedented scale of exploration and characterization to identify suitable geological formations. Unlike oil fields, whose geology has been extensively explored and developed, potential storage formations, particularly deep saline aquifers, often lack comparable geological datasets. Comprehensive exploration to ensure reliable storage capacity and containment integrity would demand significant expenditures and sophisticated subsurface modelling efforts, far beyond current industry norms.

Further complicating matters, each geological sequestration site is unique. Reservoir permeability, caprock quality, formation chemistry, and regional tectonic activity vary considerably from site to site, making generalized design and operational practices difficult to standardize. Experience at existing sequestration projects underscores this challenge. For instance, the Sleipner project in Norway has functioned successfully over decades due to favourable geological conditions, whereas the Gorgon project in Australia encountered unexpected injectivity problems, limiting storage rates far below initial expectations.

Even more troubling, the In Salah project in Algeria demonstrated the consequences of undetected faults and inadequate legacy well integrity, resulting in unexpected CO2 migration and eventual leakage through older wellbores. These real-world experiences vividly illustrate that geological storage, while theoretically viable, often encounters substantial practical obstacles that may not be identifiable until significant injection has already started.

Handing Investors’ Liability Off to Taxpayers

Given the significant technical challenges, the question of long-term liability becomes particularly acute. Current regulatory frameworks in jurisdictions such as the European Union and Alberta allow operators to transfer liability to governments after relatively short periods of post-injection monitoring, typically ranging from 10 to 30 years. This transfer of liability is designed to provide operators with clear financial endpoints and certainty, crucial for attracting private investment.

However, the longevity of geological storage, spanning centuries or millennia, means governments must assume permanent responsibility, effectively requiring stewardship indefinitely. While per-tonne monitoring costs appear modest, usually cited as between eight to thirty cents annually, the perpetual nature of such commitments accumulates into a non-trivial obligation when scaled globally to billions of tonnes per year over thousands of years.

The actual annual fiscal burden on governments at a global sequestration scale could easily reach into the billions of dollars. Although this cost is relatively small compared to broader climate and infrastructure expenditures, the indefinite nature of such commitments introduces significant uncertainty and risk. Governments historically have limited appetite for open-ended financial responsibilities, particularly those extending across generations.

It is reasonable to question whether future governments, confronted with changing priorities, budgetary pressures, or political circumstances, will reliably maintain the rigorous oversight required to prevent long-term leakage. Experience with legacy oil and gas wells and nuclear waste repositories highlights the ease with which perpetual stewardship can fall victim to political neglect, inadequate funding, or changing public priorities.

Complete Containment Forever: ‘Unproven in Practice’

Moreover, the comparison between geological sequestration wells and standard oil and gas wells emphasizes critical differences in design objectives, operating conditions, and required lifespan. Traditional hydrocarbon wells are engineered to extract fluids over relatively short lifetimes, typically decades at most, with little concern for containment beyond operational lifespans. Sequestration wells, conversely, must ensure complete containment indefinitely. The aggressive corrosion posed by carbonic acid formation in the presence of CO2 and water, coupled with thermal and mechanical stresses induced by injection operations, places unprecedented demands on well materials such as steel casings, packers, and cement.

Despite advances in corrosion-resistant materials and specialized cement blends, ensuring structural integrity over hundreds of years remains unproven in practice. The oil and gas industry’s historical challenges with long-term well integrity, evidenced by numerous abandoned wells leaking methane or other fluids decades after closure, further underscore doubts regarding the feasibility of ensuring permanent CO2 containment on geological timescales.

Scaling geological sequestration to multi-gigatonne levels only adds to these engineering uncertainties. To manage several billion tonnes of CO2 annually, thousands of injection and monitoring wells would be needed, each subject to stringent corrosion and structural integrity requirements. Sourcing sufficient volumes of specialized corrosion-resistant alloys, durable elastomers, and advanced cement mixtures at such massive scales could strain global manufacturing capacity and supply chains.

And ensuring an adequately trained work force capable of overseeing construction, operation, maintenance, and monitoring of thousands of advanced sequestration wells would be a substantial logistical challenge.

Less Need for CO2 ‘Garbage Disposal’

Given these significant risks and uncertainties, prudence suggests treating large-scale geological sequestration as a solution of last resort rather than a cornerstone strategy. Climate policy must prioritize accelerated electrification, increased renewable energy deployment, and aggressive demand-side measures to reduce fossil fuel dependency as much as possible. Restoring and expanding natural carbon sinks, including forests, wetlands, and soils, similarly provides credible and ecologically beneficial alternatives.

While I haven’t found time to do the full analysis yet, my working hypothesis is all decarbonization scenarios from the IPCC and other major organizations are wrong because they vastly underestimated solar, batteries, and global penetration of electric vehicles of all scales, and vastly overestimated hydrogen’s potential in the energy sector. Realistic scenarios that aligned with the rapid acceleration of electrification and the developing world leapfrogging the developed world would not see a need for enormous pipeline networks to sequestration sites for garbage disposal of carbon dioxide.

Ultimately, while geological sequestration of carbon dioxide may be unavoidable at some scale to meet ambitious climate targets, the engineering, economic, regulatory, and social complexities argue strongly for humility and caution, if not outright skepticism. It is crucial to recognize the genuine difficulty of guaranteeing perpetual storage across vast volumes and myriad sites, especially given troubling leakage experiences from far simpler and smaller-scale CO2-EOR projects.

Governments, investors, and policy-makers must approach geological sequestration with realism, careful scrutiny, and heightened diligence. Believing this technology can effortlessly scale or serve as a dominant climate mitigation strategy without confronting the profound uncertainties involved is neither prudent nor justified by available evidence.

Mitchell Beer traces his background in renewable energy and energy efficiency back to 1977, in climate change to 1997. Now he and the rest of the Energy Mix team scan 1,200 news headlines a week to pull together The Energy Mix, The Energy Mix Weekender, and our weekly feature digests, Cities & Communities and Heat & Power.

Map of the Week

EXCLUSIVE: ‘World Will Be Watching’ Carney’s Fast-Tracked Megaprojects as Carbon Budget Shrinks

New Alberta Cleanup Rules Undercut Renewables’ Competitiveness, Prompt Call for Federal Intervention

‘Serious Omission’ in G7 Wildfire Charter Leaves Climate Change Unnamed

Not Just a Bad Fire Season: A Personal Wake-Up Call for a Warming World

Hoping for ‘Decarbonized’ Oil Defies High School Chemistry, Climate Advisor Tells Carney

2/3 of Canadians Give Clean Energy Higher Priority, 3/4 Want Climate Policy Linked to EU’s

With EV Sales Down 50%, Environment Minister Says Rebates Will Return

‘Clean Energy CEO’ Becomes Canada’s Top Bureaucrat as Carney Names Sabia Privy Council Clerk

ABB Offers Battery Storage Subscription to Cut Up-Front Costs for Businesses

Indigenous people fleeing wildfires face immense mental health burdens. Experts say they shouldn't have to (Canadian Broadcasting Corporation)

Shell and former Nigerian subsidiary responsible for legacy oil spills (Leigh Day)

Spain’s blackout probe faults grid operator and utilities, not renewables (The Financial Times)

NASA data reveals dramatic rise in intensity of weather events (The Guardian)

Abolishing FEMA’ Memo Outlines Ways for Trump to Scrap Agency (Bloomberg)

UK harvest on a ‘knife edge’ after record spring heat (Energy & Climate Intelligence Unit)

How Black Lung Came Roaring Back to Appalachia Coal Country (New York Times)

EU proposes ban on Russian gas imports by end of 2027 (Reuters)

Sunnova and Mosaic bankruptcies highlight deepening rooftop solar woes (Canary Media)

BYD tests solid state EV batteries with nearly 1,200 miles of range (Electrek)

California Approves World’s Largest Solar + Battery Storage Project (California Energy Commission)

First Investor-Focused Climate Resilience Investment Framework to Address Escalating Physical Climate Risks (Institutional Investors Group on Climate Change)