How Lucky Do You Feel? The Bottom Will Fall Out of B.C.’s Overhyped LNG Gamble

Our governments and pension funds are betting billions on liquefied natural gas (LNG) development. Those "sure bets" are about as reliable as a craps table or a one-armed bandit.

This post is adapted and updated from an analysis that first appeared on The Energy Mix on November 1, 2020. You can find the whole story here, complete with a more detailed early chronology and pandemic-era references.

I’ve had a few friends over the years who insisted their favourite pastime was to visit their friendly neighbourhood casino. They swore it was fun, even relaxing, to set aside a chunk of cash for a few hours at a roulette wheel or slot machine (aptly nicknamed “one-armed bandits” by my parents’ generation), then pour those dollars into an organized, well-oiled system where the game is fixed and the house rarely loses.

If they could save up enough of those dollars to blow the rest of them in a gambling mecca like Las Vegas, they said, so much the better. If you’re going to spend $40, $80, $100 or more on a night out for two, they asked, what’s the difference between dinner and a movie, an outdoor concert, or a casino trip?

And always, the amped-up hope in the background: once in a while, y’know, you just might win. (But not if you just go to a movie.)

A couple of those friends were convincing enough that I stopped second-guessing their choices, though I haven’t stopped judging the purpose-built gambling joints where every design feature—from the bright, flashing marquees and low ambient lighting, to the confusing aisles and hard-to-find exits—is meant to pull you in and keep you there.

But most of us would draw a big, bright line if we thought our governments were gambling our tax dollars and pension funds on “sure” bets about as reliable as a craps table or a one-armed bandit. Particularly if they were placing bets in the billions of dollars, rather than tens or hundreds, on our behalf.

Overhyping the Shale Revolution

Understanding how those bets work, and why they’re so risky, brings us into the high-stakes, jargon-filled world of commodity futures and energy price hedging. It’s not for the inexperienced or the faint-hearted—when you try to dig in and start learning how personal investing works, you’re quickly told to stay clear of futures contracts and leave them to the “pros.”

Those are some of the same investment professionals, of course, who brought us the crash of Enron in 2001, the collapse of the U.S. mortgage bubble in 2008, and the waves of investment that brought climate change to crisis proportions. But the grain of truth is that betting it all on the success of a decades-long project, when it’s utterly impossible to predict the stable supplies, prices, demand, or geopolitics on which it depends, is unwise for any government that sees itself as a responsible steward of public tax dollars. It becomes downright dangerous when the tax revenues that fund public services in a province like British Columbia depend to any degree on a collection of projects as risky as fracking and liquefied natural gas (LNG)….

For well over a decade now, a steady drumbeat of critical analysis has raised serious concern that many of North America’s shale oil and gas deposits have been overhyped, or at the very least, overestimated. There’ve been persistent reports of fossil companies tapping out their wells faster than expected, too quickly to recover the dollars that were invested to get them into production. Their short-term solution: Cover their losses by raising more money to drill more wells…which then fall short of expectation, so that the cycle repeats and amplifies.

As one online investment guide explains it: “Investors contribute money to the ‘portfolio manager’ who promises them a high return, and then when those investors want their money back, they are paid out with the incoming funds contributed by later investors.” The company orchestrating the deals can “merely transfer funds from one client to another” as the process rolls on from one investment to the next.

The problem is that that wasn’t meant to be a snapshot of a legitimate business operation. It’s the Investopedia definition of an illegal Ponzi scheme…

This is not to suggest that all shale projects are fraudulent. But even if the producers are as shocked and dismayed at the wells’ poor performance as their investors presumably are, the history shows that relying on a shale play to pay off is extremely risky.

Certainly much riskier than, say, signing a 20-year Power Purchase Agreement for a solar or wind farm, or investing in dozens or hundreds of deep energy retrofits that will reliably deliver energy and cost savings, year after year.

Unless you’ve already made the commitment.

As any casino operator will tell you, it’s tough to break an addiction once you’re hooked. After a multi-year oil price slump began in 2014, shale producers had no choice but to keep pushing product out into a saturated market.

“The shale revolution has always been funded by massive debt,” analyst Deborah Lawrence, executive director of the Fort Worth, Texas-based Energy Policy Forum, wrote in March 2015. “Operators who were drilling for gas back in 2009-2011 used debt extensively.”

So when they produced more gas than the market could absorb and prices tanked, “many couldn’t afford to pull back production to help stabilize prices. Had they done so, they would not have been able to meet their debt payments. So they kept pumping…and pumping…and pumping.”…

How Lucky Do You Feel?

Asia—the region that accounts for more than half of gas global demand—is where successive British Columbian governments have always been intent on selling their product. Although those shipments have just recently begun, the longer history doesn’t paint an optimistic picture.

It’s a baked-in feature of oil and gas markets that prices and demand are constantly shifting. That’s why Alberta will be doomed to a boom-and-bust economy until it can diversify its economy beyond petroleum and its various spin-off products.

It also means B.C.’s gamble on LNG depends on a long list of rosy assumptions—from economic growth in Asian countries driving ever-higher demand for gas, to limited competition from sources of supply that are closer by or more convenient, to investors willing to tune out their mounting concerns about the risks of climate disruption and stranded assets. All of those unpredictable, uncontrollable assumptions have to go close enough to plan, often enough, for the bet to pay off.

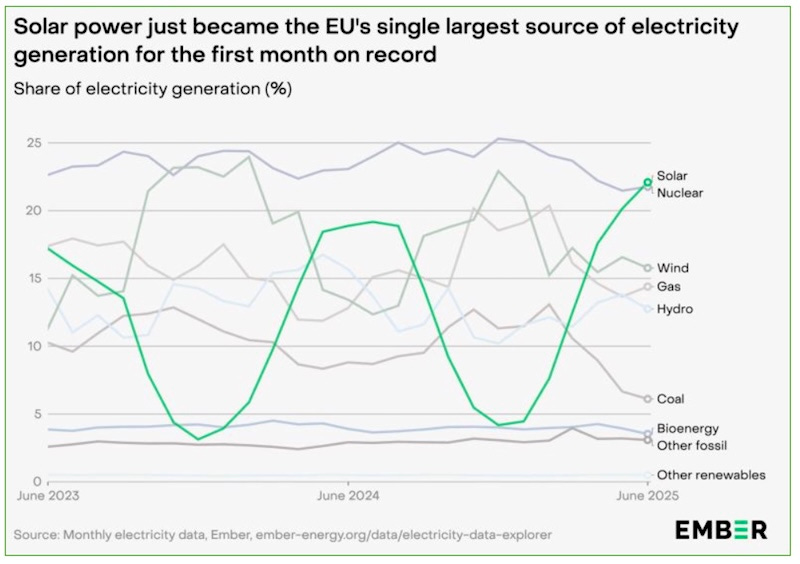

But here’s a question you rarely see LNG boosters ask: If experience in North America shows increasingly that natural gas costs less than coal in a head-to-head comparison, but solar and wind (with or without battery storage) are cheaper still, and energy efficiency is often the most affordable choice of all…if other regions of the world are reorienting their energy and climate strategies along those lines, why would anyone tacitly assume that planners in Asia would weigh the same options and come to a different conclusion?

The increasingly likely answer is that they won’t. For years, a top decarbonization priority in Asia has been to challenge coal plant construction and financing, and that battle hasn’t yet been won. But the Institute for Energy Economics and Financial Analysis reported years ago that the region was beginning its renewable energy transition. China had already been the world’s leading renewable energy investor for a decade as of mid-May, 2020, IEEFA Director of Energy Finance Studies Tim Buckley wrote at the time. And “while South and Southeast Asia have been renewables laggards, Asia is nevertheless on the cusp of a dramatic pivot. Recent developments across India, China, Japan, South Korea, Vietnam, and Taiwan highlight the potential for change.”

The region’s commitment to renewables has mostly only deepened since.

Yet LNG proponents are still counting on energy demand in Asia continuing to grow, quickly and more or less reliably, as the region develops, even as that picture keeps getting more complicated. Now, to justify a multi-decade, multi-billion-dollar provincial commitment with many thousands of jobs in the balance, British Columbia has to hope or assume:

• That faltering gas demand will recover,

• And that demand for coal-fired electricity will switch to gas,

• And that gas prices will recover steadily and consistently enough that producers can break even, but somehow avoid being undercut by renewables,

• And that in embracing gas, countries will choose to pay more than they have to for their heating, cooling, lighting, and connectivity,

• And that B.C. can meet a large enough share of that demand to justify a big LNG buildout,

• And that a region facing immediate, acute climate vulnerabilities will continue to accept an energy source whose greenhouse gas emissions are 84 times more potent than carbon dioxide over the crucial 20-year span when humanity will be scrambling to get the climate crisis under control.

Those long-term assumptions didn’t appear too sound five years ago. And now they’re undercut further by a looming glut in global LNG supplies, brought on by the massive overbuilding that analysts were warning about when this post first appeared.

That’s before factoring in the International Energy Agency’s continuing projection that global demand for all three fossil fuels will peak before the end of this decade, then go into permanent decline. But gas turbine manufacturers are listening, and their understandable jitters about long-term investments in a sunsetting industry are making it harder for utilities to acquire new gas-fired equipment, even when they want to.

It isn’t impossible, even now, that some new LNG projects will succeed. But with the technology, economics, and climate impact analyses all pointing in another direction, how likely is B.C. to see any return on the billions in taxpayer subsidies and the years of policy support it has lavished on the industry? Particularly when public opinion is quickly turning against gas, and major investors may not be far behind?

The Grown-Ups in the Room

With every economic setback, every cost reduction for renewables and storage, every new methane study, every fracking ban, every anti-pipeline campaign, every lawsuit and regulatory decision, the prospects for a continuing LNG boom become more tenuous—as a growing chorus of gas analysts now acknowledge. And “tenuous” is not the adjective you want your government to lead with when it’s investing billions of dollars in an industrial strategy on your behalf.

Whether the gamble is on an LNG pipe dream or a Las Vegas casino, the enticing draw for would-be winners is that the house doesn’t always win. One very close friend of our family beat the Las Vegas house (and lived to tell the tale) by changing up his assumptions: along with a co-worker, his goal wasn’t to win at penny slots, but to figure out how little they could get away with paying for bargain-basement beer and wine if they played slowly, drank quickly, and tipped the server lavishly. (By their own standard, they won big.)

There are two crucial differences between B.C.’s big LNG gamble and our friend’s deliberately offbeat experience: The stakes for B.C. are so much higher than penny slots. And all the unconventional influences—the shady numbers behind shale gas production, the impact of energy efficiency and cheap renewables on future demand, the looming gas glut, and the cascading impacts of an accelerating global climate emergency—will make it far more difficult to bring home a win.

And that means the likely outcome for B.C. is much closer to the wrenching fate of the gambling addicts who file into those friendly neighbourhood casinos every day. The kids semi-abandoned for hours on filthy carpets while their parents play the slots. The adult diapers stuffed between the machines by players too driven or distracted to take a bathroom break. And the gambler who could never bring in a paycheque, telling his long-suffering spouse that “bad men” always stole it from him on his way home, whose descendants can now trace the impact of gambling addiction down three generations.

The “bad men” excuse isn’t entirely wrong. From the casino to the boardroom, someone had to set out to take the money away—and when they did, people got hurt if there wasn’t a grown-up in the room to protect them.

In a democracy, we elect governments to take care of the issues that are too big to handle on our own, to be that grown-up in the room when we need someone looking out for our interests. The surest way to do that is to follow the evidence—on energy futures, carbon reductions, local economic development, Indigenous rights and title, farmland and biodiversity protection, and all the other issues the LNG file brings into play—rather than hanging on for dear life until the gamble goes up in smoke.

Mitchell Beer traces his background in renewable energy and energy efficiency back to 1977, in climate change to 1997. Now he and the rest of the Energy Mix team scan 1,200 news headlines a week to pull together The Energy Mix, The Energy Mix Weekender, and our weekly feature digests, Cities & Communities and Heat & Power.

Chart of the Week

NOT SATIRE: U.S. Politicians Say Wildfire Smoke is Ruining Americans’ Summers, Demand Canada Stop It

New Oil Pipeline to B.C. is ‘Highly, Highly Likely’, Carney Says

The Nuclear Mirage: Why Small Modular Reactors Won’t Save Nuclear Power

Climate Disasters Like Texas Floods Moving Faster Than Science Can Keep Up

Oil Use Slows in China, Saudi Arabia as Global Demand Nears Peak: IEA

Toronto Company Lands 30-Year Critical Mineral Permit in Greenland

‘Blatant Political Capture’ Feared as Saudi Aramco Economist Nominated to Lead IPCC Science Role

Texas Flood Deaths Climb Amid Questions Over Warnings

Trump’s ‘big beautiful bill’ blows U.S. emissions goal by 7B tonnes (Carbon Brief)

Trump’s budget is a setback for the fight against climate change — but it’s not the end of the story (San Francisco Chronicle)

BP says lower oil prices will weigh on earnings (The Financial Times)

Carney is walking a political tightrope on our energy future (The Hill Times)

Manitoba wildfires prompt second declaration of province-wide state of emergency (Globe and Mail)

Sacrifice Zones: Life along the fenceline between the land and industry (APTN News)

Syrian wildfires spread due to heavy winds and war remnants (The Associated Press)

BRICS demand wealthy nations fund global climate transition (Reuters)

‘Shovel-ready’ renewables prioritized as grid connections queue gets shake-up (The Standard)

America's largest power grid is struggling to meet demand from AI (Reuters)

N.C. governor vetoes bill that would have delayed clean energy goal (Canary Media)

Ukrainian approves just transition program for coal regions (Ecoaction)

I have such great concerns about BC's aspirations for lng. As well as your comments, the fracking in ne bc is doing so much damage and affects so many who live there. I am concerned when I hear Mark Carney so enthusiastic about LNG. I know how much it's been greenwashed, but the evidence, both economic - as you've aptly described, and environmental is very strong, and becoming stronger with each day. He's a really smart guy, I think - surely he's read recent evidence?

We have to find a way to stop David Eby from his glorious aspirations. 6 LNG plants, and an expansion within Metro Vancouver. It blows my mind 🤯