Oil Execs Drink Their Own Kool-Aid, Talk Down the ‘Fantasy’ of Fast Energy Transition

What else would you expect at the annual CERAWeek conference? The whole point is to pitch the industry’s story and reassure its investors, surely not to confront its existential threats.

In the opposites world of CERAWeek, the oil and gas industry’s big, annual conference in Houston, the energy transition is stumbling, its cost is prohibitive, a raging, global climate emergency is beside the point, and we’d all better dig in for another 40 years of oil and gas.

It’s a good thing the rest of us live in the real world.

To hear the oil and gas execs tell it, the energy transition that is picking up momentum all around us is just a figment of our imaginations, and it’s time to face the “hard realities” that fossil fuel consumption will grow for at least another decade or two.

"We should abandon the fantasy of phasing out oil and gas and instead invest in them adequately, reflecting realistic demand assumptions," Saudi Aramco CEO Amin Nasser told the conference. Those assumptions, he said, have oil consumption hitting a record 104 million barrels per day this year and continuing to grow through 2045.

“The current transition strategy is visibly failing on most fronts,” Nasser added. “And, despite our starring role in global prosperity, our industry is painted as transition’s arch-enemy.”

“The environment right now is very positive for the oil and gas industry,” added Alan Armstrong, CEO of Williams, the United States’ biggest gas pipeline company. “Roll the clock back four or five years ago, they were like: ‘Oh, it’s all going to be renewables and batteries’—and now they’re saying: ‘Wow, wow, this is going to be way too expensive.’”

Telling the Rest of the Story

To their credit, the daily news outlets covering CERAWeek didn’t take the executives’ hype at face value.

The Guardian connected Nasser’s speech back to the International Energy Agency’s data-driven projection that oil and gas demand will peak this decade.

CBC juxtaposed the oil CEOs’ comments with the IEA’s latest World Energy Outlook and the landmark commitment at last December’s COP28 climate summit to begin a transition out of fossil fuels, while tripling global renewable energy capacity and doubling the pace of annual energy efficiency improvements by 2030. (Fair enough—we know that a COP commitment means nothing without action and financing to make it happen, and it’s a baked-in reality that fossil fuel companies will fight those steps at every turn. But the commitment is the first step, and this one was unprecedented.)

And the Financial Times contrasted the “bullish comments” at the conference, including Armstrong’s, with “a backdrop of record temperature rises and growing scientific concern over the need to cut greenhouse gas emissions to tackle climate change.” It cited last week’s World Meteorological Organization report that declared a “red alert” while confirming that 2023 was by far the hottest year on record.

All three news stories pushed beyond the CERAWeek set piece to quote industry critics, with the Times name-checking executives from some of the companies that are already beginning to push fossil fuels to the margins.

“The fantasy is that the oil and gas industry think that by putting more emissions in the world, it gets better,” said Fortescue Energy CEO Mark Hutchinson. “You have the oil and gas industry baring their teeth,” and “now the world knows these guys are never going to be part of the solution.”

Sandhya Ganapathy, head of EDP Renewables North America, said the official line from the conference showed a “limited” view of the future role of renewables.

None of that stopped the CERAWeek panelists from doing what they were going to do. And nor should anyone have expected it to. Oil and gas executives speaking at CERAWeek have been complaining about a decline in public support since at least 2017, and things aren’t getting a whole lot better for them. So apart from the maneuver that climate communicator Ketan Joshi delightfully labels the “Snooty Rationality Gambit”, they really haven’t got many other plays left.

Which explains why, apart from any private business deals that were going on behind the scenes, spinning a positive, hopeful narrative for jittery investors and an increasingly skeptical public was the whole point of the exercise.

Standard Operating Procedure

I used to see this all the time when I worked in the meetings and events industry. There were plenty of conferences that put honest, reliable content on their programs, and those were the ones we always hoped to help document. But there were plenty more whose sole purpose was to deliver a relentlessly upbeat, motivational message, whether or not the facts on the ground actually fit the storyline.

And, really, if you were tied to an industry that was entering its sunset, what else would you do?

Would you actually admit out loud that the music was about to stop, during a high-profile event where investors were hanging on your every word?

When you knew there was no transition plan that would give them the outsized rate of return that was their only reason to associate with an industry so deeply damaging—environmentally, economically, socially, culturally—that one of its biggest global boosters called its primary product “the devil’s excrement”?

ExxonMobil CEO Darren Woods admitted as much, minus the colourfully candid language, telling the Financial Times last year that his company was focused on fossil fuels because “we don’t have a viable set of alternatives.”

Apart from that accidental departure from Exxon’s usual, reflexive gaslighting, you have to assume the wall-to-wall spin we heard last week was largely a matter of career executives telling the story they have to tell because that’s the job. That would explain why we’ve seen a good number of retired oil and gas managers step up to critique their former industry once they’ve left.

But not until they’ve left.

We witnessed another example of that dynamic just this weekend when Ronna McDaniel, the recently-deposed chair of the Republican National Committee in the U.S., appeared on NBC’s weekly Meet the Press program, a couple of days after joining the network as a commentator. The exchange is with host Kristen Welker:

WELKER: Can you say as you sit here today, did Joe Biden win the election fair and square?

McDANIEL: He won. He’s the legitimate president—

WELKER: Did he win fair and square?

McDANIEL: Fair and square, he won. It’s certified. It’s done.

WELKER: Ronna, why has it taken you until now to be able to say that?

The answer, of course, is that McDaniel couldn’t utter those words as long as she worked for Donald Trump, playing a lead role in the seditious bid to overturn the results of their 2020 election. She couldn’t speak the obvious truth before her eyes until Trump dropped her out of the job.

What’s that those keynote speakers at CERAWeek were saying again about 40 more years of oil and gas?

Behind the Narrative

But here’s the bad news for CERAWeek, and the good news for the rest of us: if it’s hard enough to control the narrative for a few days, it’s pretty much impossible year-round. And beyond the walls of the conference facility in Houston, the story is not usually the one the industry wants to tell.

In the two to three months before the conference:

• The UK’s respected Carbon Tracker think tank concluded—in early December, before the final deal was done at COP28—that the energy transition posed “growing fiscal risks” to petrostates, with falling oil and gas demand “set to put downward pressure on commodity prices and place future government revenues in jeopardy.”

• Saudi Arabia abandoned hopes of setting a higher cap on its daily oil production and curtailed investments in new oilfields, prompting analysts to wonder whether one of the world’s leading petrostates was “losing faith that the world wants to keep buying more of its oil,” Climate Home News reported. Saudi Energy Minister Prince Abdulaziz bin Salman later attributed the decision to the energy transition.

• U.S. oilfield services and drilling companies reported that job losses could mount due to insufficient demand for the gas they had planned to produce. “U.S. gas futures slumped this week to a 3½-year low, their weakest close since June 2020 when COVID-19 quashed demand,” Reuters wrote in late February.

• Around the same time, a study by the Institute for Energy Economics and Financial Analysis showed that stock price indexes that excluded fossil fuels “performed slightly better than those that didn’t” over the last decade. That was despite record fossil profits, broken climate promises, and high interest rates slowing down clean energy companies over the latter part of that period, the New York Times reported. Imagine how much more poorly the fossil stocks would have performed without US$13 million per minute in government subsidies, every minute of every day of the year, according to the World Bank? Imagine how much energy transition and climate resilience that subsidy money could buy!

• Oil and gas companies were taking advantage of those record profits to reshape their production portfolios for a future of $30-per-barrel oil—a clear acknowledgement that demand for their product is about to collapse.

Time for Some Real Talk

It’s a good bet that the real talk and strategizing in the backrooms in Houston was different from the sunny (but mostly not solar) storyline on the main stage. That’s hard to say for sure from a distance—while CERAWeek was taking place, I was one time zone and about 2,800 kilometres away. But on some level, it doesn’t matter.

As the transition unfolds, far faster and better than the fossil fuel industries want you to believe it will, they won’t be the only ones who do what they’re going to do. Companies like Fortescue and EDP, investors looking for lower emissions and reliable returns, governments competing for green energy investment and jobs, consumers looking for cheaper, more resilient energy, and advocates pushing for a faster fossil phaseout—we’ll all be a part of the picture, too.

That means the oil and gas CEOs of CERAWeek will only win if the rest of us let them. Which is not nearly the sure bet they need everyone to think it is.

Mitchell Beer traces his background in renewable energy and energy efficiency back to 1977, in climate change to 1997. Now he and the rest of the Energy Mix team scan 1,200 news headlines a week to pull together The Energy Mix, The Energy Mix Weekender, and our weekly feature digests, Cities & Communities and Heat & Power.

Chart of the Week

‘No Justification’ for Delaying Full Corporate Climate Disclosure, Experts Tell Standards Board

UPDATE: Federal Budget to Include Revamped Greener Homes Grant

2 Big Financial Boosts Herald New Momentum for Battery Recycling

‘Reason-Based Wrecking Ball’ Demolishes the Case for Alberta Restrictions on Renewables

‘Multi-Billion-Dollar Opportunity’ for Atlantic as Wilkinson Inks Wind-Hydrogen Deal with Germany

Time for Canada’s Power Grids to Mainstream Battery Storage, Analysts Say

El Niño Weakens, GHGs the ‘Main Culprit’ after Record Year Of Heat, Drought, Wildfires

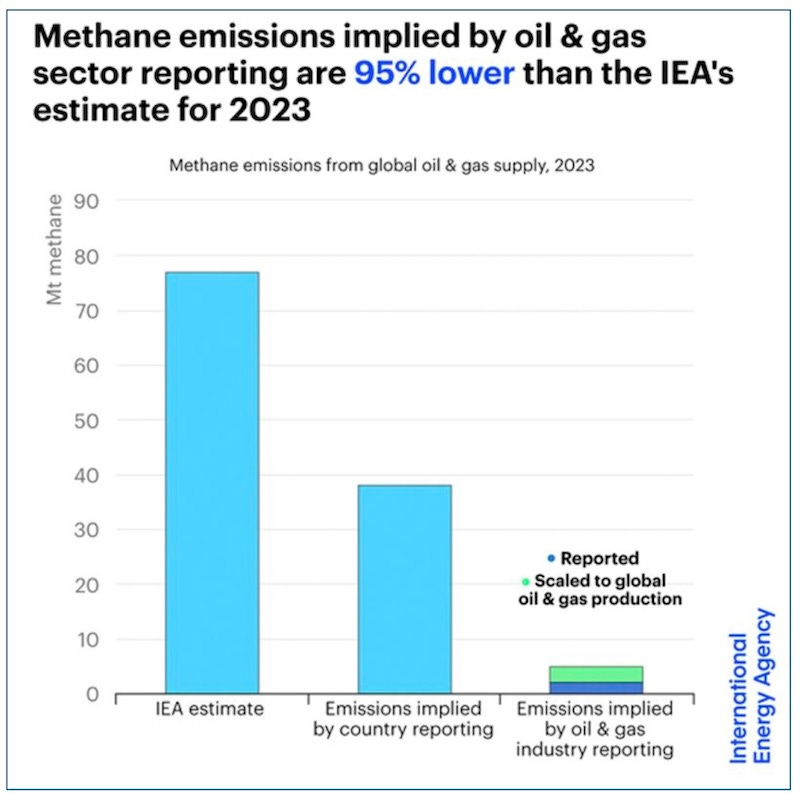

Canada in Top 10 Emitters as Methane Pollution Holds Near Record Levels in 2023

New Designs Make Heat Pumps Available to Apartment Dwellers

Shareholder proposal calls on Enbridge to disclose indirect emissions from pipelines (Globe and Mail)

Nisga'a Nation and Western LNG partner to purchase natural gas pipeline project (Canadian Broadcasting Corporation)

Methane to become key criterion for future EU energy imports (Reuters)

B.C. unveils $39M for climate emergencies, new flood plan (Canadian Broadcasting Corporation)

Cleanup for pollution from Teck coal mines will top $6.4-billion, assessment claims (Globe and Mail)

Zombie car factories on the rise in China as buyers opt for EVs (Financial Times)

Why a shrinking US aluminum industry is tricky news for clean energy (Canary Media)

Global protected area policies spark conflicts with Mexico Indigenous groups (Mongabay News)

‘We don’t know where the money is going’: the ‘carbon cowboys’ making millions from credit schemes (The Guardian)

Belgian Farmer Sues TotalÉnergies for Climate Impacts (The Farmer Case)

Boeing's big green disaster (HEATED)

Cargill Tests Wind Propulsion Tech for Shipping (Smart Energy Decisions)