Royal Bank’s World-Leading Fossil Investments Put Spin Over Science

It took a whole lot of magical thinking and cooked messaging to make RBC the world’s biggest fossil fuel funder. Now they’re doing a great job of doing harm. Just don’t confuse them with facts.

Here’s the thing the rest of us need to understand: When you’re Royal Bank of Canada CEO Dave McKay, or even a report writer for the Canadian Chamber of Commerce, you don’t have to follow the laws of science. Nor even the much more porous, arbitrary “laws” of economics.

When you get to write your own narrative, the storyline is the only reality that matters. Even if it’s burning down the house.

That’s what was going on at the RBC annual general meeting earlier this month, where McKay sought to justify his institution’s status as Canada’s leading fossil fuel bank. He stressed what he called an “orderly” transition away from fossil fuels, warning that instability in food, energy, or international security will throw off efforts to rein in climate change, The Canadian Press reported.

“Where any of those, one or more of those elements, aren’t present, then the focus on this critical climate journey is put aside,” he said.

Let’s start with the blindingly obvious, shall we?

Anyone with the slightest real concern for food security, energy transition, or international peace and security can lay hands on a mountain of evidence that all of those global crises—all of them—are turbocharged by a climate emergency that accelerates when banks like RBC pour more money into fossil fuel companies that keep throwing fuel on the fire. McKay was holding forth not long after the latest science assessment by the Intergovernmental Panel on Climate Change flagged exactly those risks among many others.

An Excellent Job of Doing Harm

But then, scarcely a week later, we learned that McKay and his team are a lot more talented than we thought. They’re actually excelling in their field, and not in a good way.

RBC isn’t just the biggest fossil backer on the Canadian scene. In 2022, it was the world’s top funder of oil, gas, and coal projects, with a mind-bending US$42.1 billion on offer—$11.5 million per day—according to the annual Banking on Climate Chaos report. That included a particularly pernicious, world-leading $7.4 billion for oil and gas fracking, an extraction process tied to the latest “alarming” increase in methane emissions.

Methane is a climate super-pollutant with about 85 times more global warming potential than carbon dioxide over the crucial, 20-year span when most of us—those of us outside the RBC boardroom—will be scrambling to get climate change under control. Experts see methane controls as one of the quickest, most promising short-term responses to the climate emergency, and the IPCC cited it as one of the three cheapest ways to get the fastest emission reductions, alongside solar and wind power.

But not if RBC has its way. The bank has been focusing more of its economic research on the energy transition, producing gargantuan cost estimates for unproven but fossil-friendly decarbonization paths that are tailor-made to run over budget and, well, break the bank. The magical thinking behind those high cost figures shows the bank’s researchers are either genuinely or deliberately unaware of the most affordable ways to cut carbon—massively increasing energy efficiency, electrifying most energy uses, decarbonizing the grid, decentralizing where we can, and rapidly phasing out fossil fuels.

RBC recently hired a new senior director of climate communications who’s been curiously unwilling lately to answer interview questions from The Energy Mix. (C’mon, of course we’re being high maintenance and taking this personally!)

You would almost think the RBC brain trust knows full well that change is in the air, that the fossil industry is on borrowed time, and has made a conscious decision to rely on spin when there’s no substance, science, or evidence to support a deeply toxic investment strategy. Except, nah, that couldn’t be.

Partying Like It’s 2006

But let’s not imagine that RBC is out there on its own. Early this month, the Canadian Chamber of Commerce became the latest business influencer demanding a massive boost in natural gas extraction, even urging bigger taxpayer subsidies for international gas plant sales.

“Of all the established energy options, natural gas is by far the cleanest, emitting half the carbon into the atmosphere as coal,” wrote report author Eric Miller, a fellow of the Chamber’s Future of Business Centre and president of the Rideau Potomac Strategy Group. “If just 20% of Asia’s coal-fired power plants were converted to natural gas, global emissions would be reduced by more than Canada’s total annual emissions. In other words, converting a relatively small share of Asia’s power infrastructure would ‘save a Canada’ in emissions.”

The report urges readers to recognize fossil gas as “an essential component of a lower-carbon energy mix”, treat gas produced under a carbon price as a “superior and more marketable product”, and “promote the understanding of the engineering and economics around an eventual transition from natural gas infrastructure to hydrogen.”

It’s curious that the Chamber, whose tagline is “the future of business success”, would want to build that future on an industry whose output needs to fall 55% by 2050 in the International Energy Agency (IEA)’s net-zero scenario. Talking to Miller last week felt like stepping into a time warp with someone who’s trying to do a good thing, but can’t make the available facts fit his conclusions. He’s partying like it’s 2006, Stephen Harper’s notion of Canada as a fossil energy superpower is still a thing, and concerted international climate action is still an afterthought.

“if we’re going to decarbonize, we have to focus on where we can make progress in big chunks,” and “people tend to reach to the easiest, most readily available energy source, even if it’s horrendously polluting,” Miller told me in an interview. With ample gas reserves to replace future coal plants in Asia, “I think Canada has a huge amount going for it. The world really does need more Canada and more of what Canada produces.”

Miller’s dream scenario amounts to setting off a made-in-Canada carbon bomb, the 130,000 square-kilometre Montney Shale formation straddling the B.C.-Alberta border, then subsidizing buyers in Asia to accept the gas under long-term contracts. The Montney is believed to contain shale gas equivalent to 140 years of Canadian demand, CBC reported last month.

“You provide financing to build gas-fired power plants in Vietnam, Indonesia, and other places that would want to do this, then you link those facilities with long-term supply contracts coming out of Canada,” he explained. “So in essence, Canada is putting out resources to build the baseline infrastructure, and as a condition of putting up those resources, there’s an intake agreement that they would fuel those plants with Canadian natural gas and put significant quantities of electricity into the national grid system.”

Which is a longabouts way of saying we’ll arm-twist developing countries with growing energy needs and limited cash into locking in carbon- and methane-emitting infrastructure, using loans or loan guarantees from Canadian taxpayers to continue frying the atmosphere for decades to come. Then those same poorer and more vulnerable countries can continue trying to cope with the worst impacts of the climate emergency.

Have we got that right?

Don’t Confuse Us With Facts

The disconnects between Miller’s findings and the wider realities he had to navigate led to a slightly bizarre call-and-response in the course of our interview.

Did he factor in the plummeting cost of energy alternatives, recognizing that wind and solar with storage are already cheaper than gas power plants in Ontario and Alberta—ahead of another 40% price drop predicted by 2035? “To be honest, I’ve laid out the concept, but that would be for another paper to go through and do the estimating,” he said. “I haven’t gone through and laid out a precise accounting.”

How could he support a shift from coal to gas when methane emissions make fossil gas just as serious a climate polluter, with fossil companies under-reporting their emissions and gas stoves releasing methane even when they’re turned off? “The methane situation is something that needs to be seriously looked at,” with countries like the United States offering “very significant incentives to deal with the methane challenge.”

With a list of references that includes five IEA data releases, why didn’t Miller’s report mention the Net Zero by 2050 scenario from the agency that styles itself the “gold standard of energy analysis”? “I would have to go back and look at that,” he told me. After a long pause, he said he was familiar with the IEA modelling, but left it out of his analysis because “the report was about natural gas, it wasn’t about what the IEA thinks the scenario looks like.”

Did he factor in the IPCC’s latest, extensive assessment of global climate science and decarbonization, its first comprehensive report since 2014? “I heard they were reporting, but again, my focus was to look at natural gas…it’s not a report to broadly say we should do x and do y to look at the relative demand picture.”

Before picking up the industry talking point that it will be easy to convert today’s fossil gas infrastructure to carry hydrogen, did he read in on the basic science behind the claim? “I’ll caveat this by saying I’m not an engineer, but intuitively, you’re moving a gas through a pipe system. So it’s like any infrastructure.”

The Transition Needs Substance, Not Spin

As we talked, Miller made a great point about the limitations of today’s net-zero scenarios and climate emergency declarations—once we’ve decided what we want to do, it’s a lot more complicated to figure out how we get it done and deliver on time. But that doesn’t mean doubling down on an impractical, hideously expensive future of expanded fossil infrastructure that only makes sense if you ignore the science and impacts of climate change.

The practical and institutional obstacles to a clean energy future are real. They can and must be solved. But a clean energy path has two big advantages over the fossil industry’s positioning statements: it can actually deliver, and a transition done right will make lives better, not worse. Institutions like RBC and the Chamber of Commerce make that work harder than it needs to be by pitching false solutions at every opportunity.

Mitchell Beer traces his background in renewable energy and energy efficiency back to 1977, in climate change to 1997. Now he scans 1,200 news headlines a week to pull together The Energy Mix and The Energy Mix Weekender.

You can also bookmark our website for the latest news throughout the week.

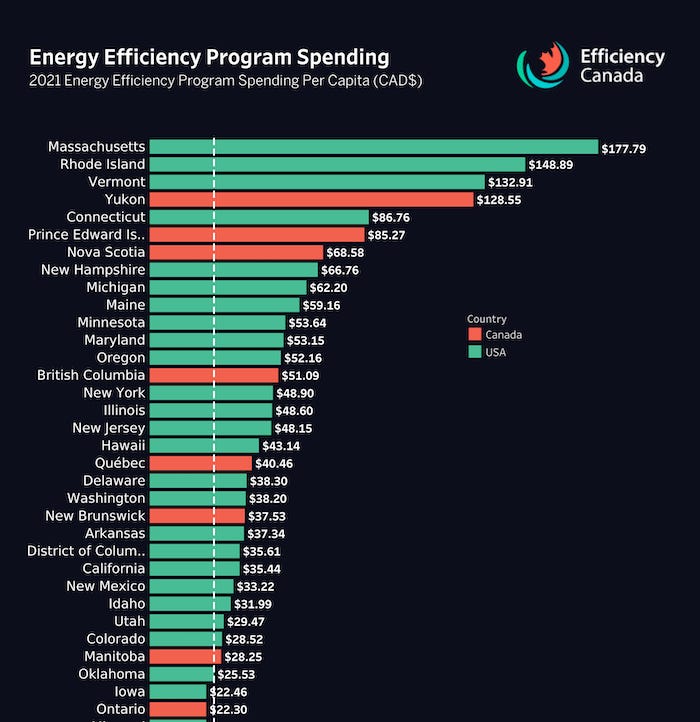

Chart of the Week