#TBT Low-Carbon Trade is Canada’s Trump Card Over Trump

Trump is known for always, always overplaying his hand. This time, his non-stop bullying and intimidation might prod other countries into the low-carbon trading system we always wanted.

With Donald Trump’s preposterously-named “Liberation Day” tariffs set to take effect this Wednesday, April 2—and Politico reporting that no one in the White House has a clue what form the final announcement will take—we’re updating and republishing a February 23 post on the new international trading system that countries outside the U.S. are scrambling to build.

If that system is guided by a tough carbon standard that drives down emissions while speeding up the shift to a green economy, it could be a powerful win for all the countries that take part. And Canada, at least for the moment, is emerging as one of the leaders of the pack.

It’s just a possible pathway, not a prediction. But if you take some of the elements of our current geopolitical moment and stack the building blocks just right, you can imagine Donald Trump’s ham-fisted tariffs shocking Canada into the diversified trading relationships it needs—with emission reductions receiving top billing.

If it works, it will be because a tough, meaningful standard for low-carbon exports becomes the trump card (lower-case ‘t’, please) in the economic warfare the rogue regime in Washington, DC has brought to our doorstep.

The win would require some big choices—bolstering a recently mostly performative set of national climate policies with serious, consistent curbs on emissions, and quickly relinquishing our status as one of the world’s biggest fossil fuel exporters—all of that as cleaner, greener economic relationships flourish. But that’s no more and no less than the pivot that many of us have been working for for years and decades, supported by clean energy and industrial alternatives that are practical, affordable, and ready to scale up.

Most important, it responds to the continuous flow of alarming news of record temperature rise, ocean warming, and ice loss, devastating and deadly wildfires, crippling drought, rising climate pollution, and “planetary solvency” risks, all evidence of a global climate emergency running out of control.

But how sweet would it be if we could look back in five, 10, or 15 years and realize that the unremitting, deliberately-choreographed avalanche of horrors that we’ve all witnessed over the past two months became the final catalyst for countries to get their act together on an even bigger crisis?

Production Note: Wherever you are, there’s probably a Hands Off rally somewhere near you next Saturday, April 5. We’ll be outside the U.S. embassy in Ottawa that afternoon with our #ElbowsUp and, as a couple of friends said online earlier this week, our #HeartsFull.

Read Where the Trade Winds Are Blowing

With Canadian hockey legend Wayne Gretzky falling out of favour over his embrace of Trump and apparent favouritism to the U.S. team during the 4 Nations hockey final last month, “skating to where the puck is going” might not be the metaphor we want for Canada’s economic future. Or our future sovereignty. Maybe the new mantra for a new era is to read where the trade winds are blowing.

The international trading system is hideously complex, and it isn’t an area where I can claim any specific expertise. But particularly in light of Trump’s ceaseless attempts to bully other countries and bend them to his narcissistic will, here are a couple of basic truths to keep in mind:

You can only sell a product, service, or concept that someone is willing to buy.

And being relentlessly unpleasant or, in Trump’s case, actively hostile isn’t the best way to build a positive, long-term partnership.

In fact, the outpouring of reaction to his mutterings about Canada as a 51st state show how quickly a decades-long relationship can be irretrievably broken.

So is there a market for global trade that puts clean, climate-friendly products at the centre and gradually turns away from the oil and gas exports at the frozen heart of Trump’s malign agenda?

Veteran climate analyst Dan Woynillowicz, principal of Polaris Strategy + Insight in Victoria, B.C., pulled together some of the numbers in a LinkedIn post last month. He pointed out that:

• 107 countries representing 82.2% of global emissions had communicated some form of net-zero target as of January 2024, according to the Climate Watch Net-Zero Tracker. Some 29 of them, including Canada, had enshrined those targets in law, while another 60 had published them in policy documents.

• Of immediate significance for Canada, “states representing two-thirds of American GDP have emission reduction targets,” Woynillowicz wrote, and seven of them are among the top 10 import markets for Canadian products.

• After the U.S., “it's notable that the next 10 top Canadian export destinations also have net zero commitments.”

We know that there’s often an excruciatingly long distance between climate pledges and real climate action. But outside Trump’s bubble of delusion and mob boss intimidation, there are indications every day that governments and financiers largely understand the cascading, global climate emergency that is upon us. Increasingly, they get it that nothing else will matter if they don’t respond. Even if, with some courageous exceptions, they can’t bring themselves to say it out loud right now.

As one example of what U.S. states will be up to in the age of Trump 2.0, Canary Media reports that nine of them—including the one that styles itself the world’s fifth-biggest economy—“have enacted Buy Clean laws to boost demand for lower-carbon steel, concrete, asphalt, glass, and other industrial products.” California got the ball rolling in 2017. Oregon, Colorado, Washington, New York, New Jersey, Maryland, Minnesota, and Massachusetts have since followed suit. And “agencies in other states are starting to adopt similar strategies, including by collecting emissions data about products used in public works projects.”

With sensible thinking like that, maybe these are the top candidates for Canada’s next nine provinces or territories? (Can we please add Vermont, just out of personal preference?)

All of which is a longabouts way of saying that the markets where we already have trading relationships are demanding the low-carbon products and services that we should already want to send them—however much Trump might huff and puff. (Much as we might regret growing up with the image of a big, bad wolf…if the one in the White House tries to blow down a net-zero building made of low-carbon concrete or mass timber, or the solar microgrid that powers it, how do you really think that’s going to end for him? We’ll bring the popcorn.)

Looking Beyond Our Shores

As Woynillowicz and Climate Watch pointed out, the emerging demand for low-emissions trade isn’t just a North American phenomenon—nor even a trend that North America is leading.

The European Union adopted the world’s first carbon border adjustment mechanism (CBAM) in 2023, and its implementation is set to begin this year. So it’s surely no mistake that Liberal leader Mark Carney has talked about replacing the hated consumer carbon tax by introducing a CBAM regime with other like-minded countries if he forms a government after Canada’s April 28 election.

That thinking leads toward a plausible and really promising future where climate impact is a key criterion guiding trading relationships, as long as the system is rigorous enough to deliver real-world results. If a country is seriously and measurably reducing emissions, it qualifies. If it isn’t, it gets politely but firmly left behind. One of the important caveats on CBAMs is that they risk disadvantaging developing countries that have done the least to pour climate-warming gases into the atmosphere, but lack the investment dollars to decarbonize their economies. The EU is looking into that problem [pdf], but maintains so far that “given the nature of the goods under the current scope of CBAM, developing countries and [least-developed countries] are not the most affected.”

As multiple commentators have pointed out, trade and business relationships can’t be reset overnight. But a crisis is a time when things move faster and change more profoundly because they have to, and the David Suzuki Foundation has a good summary of the problems with today’s trading system and the solutions that are already emerging.

We can love it or hate it that Trump is blowing up the old “normal”—whether that’s the massive, preferential access the U.S. has enjoyed to Canadian resources, or Canada’s corresponding dependence on oil and gas export revenue. But whether you think of that place as comfort or paralysis, there’s no going back. Which opens up what may be a once-in-a-lifetime opportunity to decide what we want to do next.

The World Is Moving On

Canada’s future trading partners are already making those choices. In the first week after Trump’s inauguration, a small flurry of analysis indicated that the rest of the world is moving on—not least because countries have already seen eight years of punitive, provocative U.S. tariffs under the Joe Biden presidency as well as Trump 1.0, and they’re quite rightly fed up.

During a period when four out of five countries around the world saw trade increase as a share of their GDP—with gains of at least 10% in more than a dozen jurisdictions—the U.S. share has “declined significantly”, according to Rockefeller International Chair Ruchir Sharma.

That trend is most definitely paralleled by an emerging, global shift in energy priorities. “Most major economies are investing in ever-cheaper solar and wind power,” the New York Times wrote. “Even as coal, oil, and gas still power the global economy, and more fossil fuels are burned year after year, the movement globally is toward heavy investment in solar, wind, and batteries, the prices of which have fallen sharply in recent years.”

Now, Trump’s obsession with tariffs and his boundless hostility toward China are prompting Asian countries to reorder their trading relationships to reduce their immediate vulnerability. “The result could be a domino effect of protectionism, with countries turning inward and raising tariffs in response to American trade barriers,” the Times reported last week.

“There is a risk that the U.S. really overplays its leverage,” said Simon Evenett, a professor at IMD Business School in Switzerland. “The U.S. market is still the biggest in the world, but proportionally it is lower than it was 20 years ago.”

Or, as Social Capital Partners Chair Jon Shell wrote on LinkedIn this week:

The EU, UK, Canada, Japan, South Korea, and Australia (I'm now calling them "EU + 5") collectively have 760 million people and control 34% of the global economy and vast quantities of natural resources….

The best way to beat a bully is for the rest of the group to rise up against him.

The Reality Outside Trump’s Bubble

Last month, we were already seeing some wonderful glimmerings of optimism and pushback against Trump’s rolling attempt at a coup d’état. (Let’s call it what it is, shall we?) In the last week, the wheels have really begun to fall off the clown car—it must be true, because we all read it in an encrypted chat on Signal. And Bill Clinton-era U.S. labour secretary Robert Reich has some of the other details in his latest “six small morsels of hope”.

In the wider world, reality is beginning to bite.

Trump’s “Drill, Baby, Drill” obsession is still running headlong into a global natural gas glut that will hit in the next couple of years and drive down profits for producers that are already borrowing billions of dollars to mollify skeptical investors.

Europe is still working to reduce its dependency on liquefied natural gas (LNG) from all sources, after Russia’s war in Ukraine drove home the message that the continent must never again be dependent on imported energy from anywhere, however friendly or accommodating a supplier might seem. (Trump’s hostility must surely have reinforced that learning.) Europe’s LNG imports fell 19% last year, the Institute for Energy Economics and Financial Analysis reported last month, with demand hitting an 11-year low, and U.S. imports declined 18%.

In Canada, with the cards increasingly stacked against Trump, we get to decide which side we’re on. Just hours after the Canadian team “annexed” the 4 Nations championship in last month’s tournament, it was mandatory for that observation to lead back to another round of sports chatter.

“Just going to state this matter-of-factly,” The Sports Network’s Dave Naylor wrote on social media. “The honourary [sic] captain for Canada in this game publicly supports a political leader whose position is that Canada should not exist as a nation.”

But what if the hero for the moment is a former Harvard University hockey goalie, now donning a business suit to play on a vastly bigger rink—not because of the partisan stripe he’s adopting, but because of the depth of climate, trade, and central banking expertise he brings to the job?

Once more with feeling—none of this will be easy, and none of it is yet certain. But if we hold a trump card, it’s time to play it. And if an understanding of climate change and the benefits of low-carbon trade is our competitive advantage over the convicted felon (etc. etc.) now occupying the Oval Office…well, we know the assignment.

Mitchell Beer traces his background in renewable energy and energy efficiency back to 1977, in climate change to 1997. Now he and the rest of the Energy Mix team scan 1,200 news headlines a week to pull together The Energy Mix, The Energy Mix Weekender, and our weekly feature digests, Cities & Communities and Heat & Power.

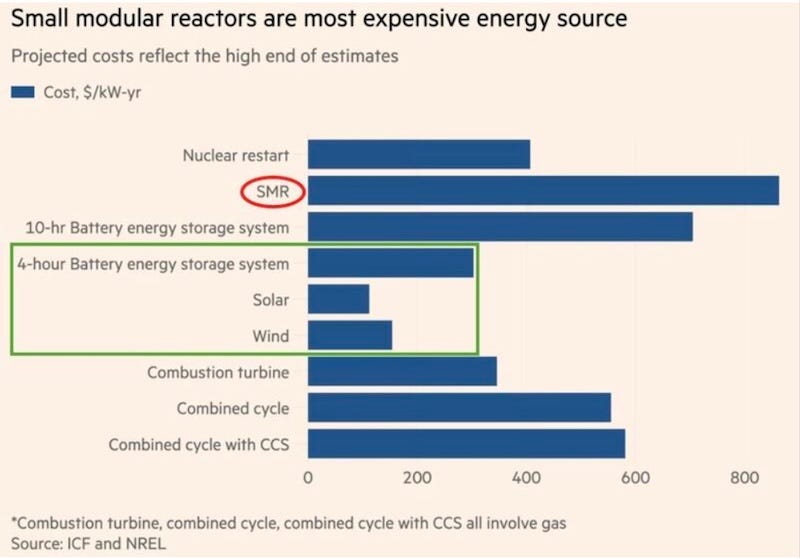

Chart of the Week

Carney Embraces Emissions Cap, CCS; Smith Touts Poilievre as Trump’s Best Bet

New BYD EV Models Gain 400-Km Charge in 5 Minutes, Widening Lead Over Tesla

Turbine Shortage Could Crimp Canadian Utilities’ Plans to Scale Up Gas

TransLink Faces ‘Significant Cuts’ After Federal Boost Leaves Massive Funding Gap

‘Not If, But When’: Cities Face Rising Climate Risk as Downgrade Jolts U.S. Municipal Bonds

TAF Highlights Energy Cost Savings, Job Creation in ‘Made-in-Canada’ Policy Pitch

Climate Change Contributes to Surge in Global Energy Demand: IEA

Wilkinson, Health Expert Scorch Oil CEOs for Demanding Deregulation

Canadian Emissions Hit 27-Year Low, Oil Sands Up 143% in Latest National Inventory

Arctic ends winter with lowest sea ice cover on record – scientists (The Standard)

'Shocking' mass bleaching drains life from Australian reef (France 24)

Millions of fish killed after getting trapped in Bruce Power nuclear plant’s intake system, First Nation says (Toronto Star)

Feds to contribute up to $200M for Haisla-led project to ship liquefied natural gas to Asia (Canadian Broadcasting Corporation)

New Alberta working group to tackle problem of $253M in unpaid oil and gas property taxes (Canadian Broadcasting Corporation)

As we dump carbon taxes and push pipelines, remember there’s no such thing as a free lunch (Globe and Mail)

Shell Aims to Grow LNG Sales by 5% Annually (Rigzone)

Shell halves green spending as boss Wael Sawan eyes 'obscene' £15m pay bonanza (This Is Money)

Tesla Recalls Nearly All Cybertrucks Over Stainless Steel Panels Falling Off (New York Times)

Britain’s greenhouse gas emissions fell 4% in 2024, government data shows (Reuters)

How a Cheap Drone Punctured Chornobyl’s 40,000-Ton Shield (New York Times)

Climate, Risk, Insurance: The Future of Capitalism (Allianz SE via LinkedIn)