The Worst Case for Canadian Oil and Gas is a Taxpayer’s Nightmare

In the end, it may be voters lying awake, staring at the ceiling, wondering how the oil industry’s bills will be paid.

A week off includes two weekends! So The Weekender is passing the mic to two of our favourite climate and energy writers, beginning today with Markham Hislop of Energi Media. You’ll find the original version of his post here.

Business owners are asked all the time how they intend to repay a loan in a worst case scenario. The lender would be negligent to not ask the question. Why, then, are politicians not asking the same question of oil companies looking for public subsidies (think carbon capture and storage)?

I call this Mother’s Admonition: Hope for the best and plan for the worst, but under no circumstances should you plan for the best and ignore the worst.

Yet, this is precisely what Canada does. Over and over again when it comes to the oil and gas industry.

Let’s look at just one example, the Alberta oil sands.

Oil sands account for the lion’s share of the Canadian industry. Alberta’s total oil production is four million barrels per day, and 3.3 million barrels (83%) come from the oil sands. That puts Alberta on par with Middle Eastern producers like Iran and Iraq. Hydrocarbons, led by the oil sands, are Canada’s leading export by a mile, usually twice the size of automobiles and parts. Nationally, the sector directly employs 208,000 workers.

The oil sands’ Achilles heel is its greenhouse gas emissions. All by itself, it accounts for 12% (84 megatonnes in 2022) of Canada’s total. Some recent projects with a better resource have emissions per barrel of around 40 kilograms of CO2 equivalent (kg per CO2e/b), which is in the ballpark of the U.S. national crude oil average of 31 kilograms. But plenty have much higher emissions, some as high as 160 kg per CO2e/b. The industry average is 68 kg per CO2e/b, one of the highest in the world.

Canadian Energy Regulator modelling shows that if global oil demand peaks, then declines, causing prices to fall, the cost of decarbonizing that emissions-intensive bitumen rapidly leads to falling production beginning in the 2030s.

That’s the worst case scenario for the oil sands, but it’s entirely plausible, according to economic modelling from BP and many other organizations (the International Energy Agency, BloombergNEF, Rocky Mountain Institute, Oxford Institute for Energy Studies, to name a few).

If oil sands companies begin to fail, or if their revenue is barely enough to survive, who covers their losses? There are three types of losses taxpayers should worry about because the numbers are really, really big.

#1: $130 Billion of Environmental Liabilities

Who cleans up old assets after they no longer produce oil? For the oil sands, those liabilities could be well north of $130 billion. You read that correctly: billions. The reason for the huge number is that Alberta has never, ever taken security deposits at the beginning of an asset’s life to pay for reclamation at the end. Instead, it assumes the companies will be around to pay for cleanup. What happens when those companies can’t pay?

This is a deeply flawed system that Alberta refuses to change. The federal government doesn’t have the constitutional jurisdiction to change it, even if it were inclined to, which it is not.

#2: $50 Billion of Decarbonization Subsidies

The second type of loss is the subsidies the oil sands are demanding to decarbonize. The Pathways Alliance, the oil sands companies’ lobby group, puts the bill at around $75 billion, of which former Cenovus Energy CEO Alex Pourbaix has said governments must pay $50 billion. Ottawa has already provided over $7 billion of investment tax incentives just for the oil sands, and more is expected. The Alberta government announced its own support program.

The companies are asking for much more. They hint that current carbon capture plans may be delayed or cancelled if more regulatory and financial “certainty” is not provided by governments.

#3: Stranded Assets (Who Knows?)

This number is harder to pin down.

But will taxpayers provide the subsidies to build capture equipment for oil sands projects, the pipeline feeders, the CO2 pipeline to a storage hub near Cold Lake, Alberta—then have to pay down the road to rip up all that material and reclaim the landscape?

Yes, in the event of a worst case scenario. There is no one else to do it. Unless, of course, governments decide not to clean up anything and Alberta is left with 9,000 square kilometres of heavily disturbed northern ecosystem filled with dozens of huge ponds filled with toxic tailings and several dozen giant industrial complexes, including all the associated infrastructure.

Bottom Line: Many Hundreds of Billions on the Line

Add up all the potential costs and the worst case scenario for the oil sands is a massive expense. Certainly more than Alberta taxpayers could manage, which means all Canadians would be on the hook.

Are politicians, regulators, and industry considering that worst case scenario?

About six months ago, I emailed the offices of Natural Resources Minister Jonathan Wilkinson and Environment and Climate Change Minister Steven Guilbeault. I asked if the ministers had considered worst case scenario modelling when considering carbon capture and storage subsidies. A straightforward answer was not forthcoming.

During Alberta Premier Danielle Smith’s media conference at September’s World Petroleum Congress in Calgary, I asked her if she had a Plan B if her rosy view of the oil and gas future didn’t pan out. There is no Plan B.

The reasonable conclusion is that the Alberta and Canadian governments are committing taxpayers to unimaginable amounts of potential financial obligations and liability without properly assessing the risk of a worst case scenario.

And that’s just for the oil sands. There is still Alberta and Saskatchewan conventional oil and gas production, British Columbia gas production, and the East Coast industry to consider.

How do politicians sleep at night? CEOs presumably sleep like babies because they are happily transferring as much of their risk as possible to the Canadian public.

In the end, it may be voters lying awake, staring at the ceiling, wondering how the bills will be paid in the harsh light of day.

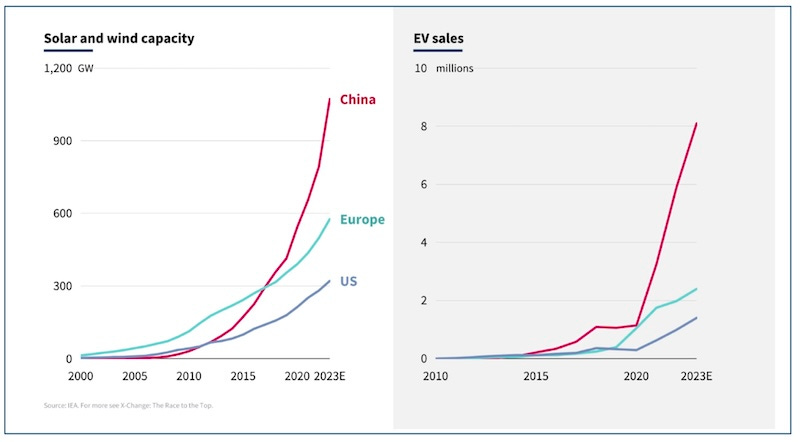

Chart of the Week

Harris Brings History of Green New Deal Support, Fossil Fuel Lawsuits to U.S. Presidential Race

Debris From Broken Wind Turbine Blade Washes Up on Nantucket Beaches

Eyewitnesses Share Aching Worry as B.C., Alberta Wildfires Send Thousands Fleeing

Green Taxonomy Coming Soon with Tough Rules for ‘Transition’ Investments

Vancouver Rolls Back Bylaw Restricting Gas Heat in New Buildings

Markham, Ontario to Build World’s Biggest Wastewater Energy Transfer System

Western Wildfires Bring Heartbreak, Anxiety as Jasper Burns, Thousands Flee

Nova Scotia Races For Coal Exit Amid Billions in Costs and Energy Challenges

TransLink Warns of 50% Service Cut as Advocates Decry Gap in Operating Funds

By backing fossil fuels, insurance companies are underwriting climate disasters like Toronto's floods (Corporate Knights)

Philippines in ‘race against time’ as oil tanker capsizes off Manila (Al Jazeera)

The growing problem of how extreme heat damages mental health (Carbon Brief)

How many climate blows before communities start to break? (The Crucial Years)

Toronto charity acquires anti-flood barriers for next emergency (Canadian Broadcasting Corporation)

NRCan’s new RFP for public and private EV charger funding shaped by critical audit, new demand forecast (Electric Autonomy Canada)

PEI sees 'exponential growth' in solar energy production (Canadian Broadcasting Corporation)

$3.7 Billion Fusion Startup Leaves Scientists Puzzled (Bloomberg)

In Northeast Ohio, Hello to Solar and Storage; Goodbye to Coal (Inside Climate News)

Starmer to take on Labour councils that block pylons delivering clean energy (The Guardian)

BASIC bloc slams 'leadership void' on climate change, finance (Reuters)

Shell quietly backs away from pledge to increase ‘advanced recycling’ of plastics (The Guardian)